A treatment or procedure gone wrong could mean a law suit today, especially with consumers becoming more aware of their rights.

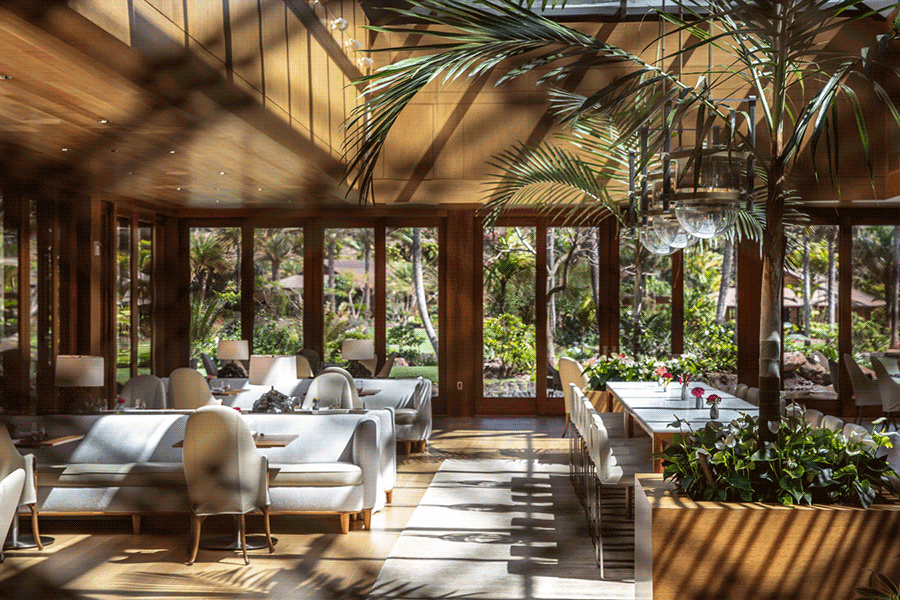

AWith the rise in the consumption of Beauty and Hair treatments or products, Salons are the ultimate destination for self-care and grooming. Salons focus on making the client feel good and look great while taking utmost care of how the treatments are done to ensure perfect results.

However mistakes can happen, leaving an unhappy customer blaming the salon and the staff and leaving them in a vulnerable situation.

The need for salon insurance

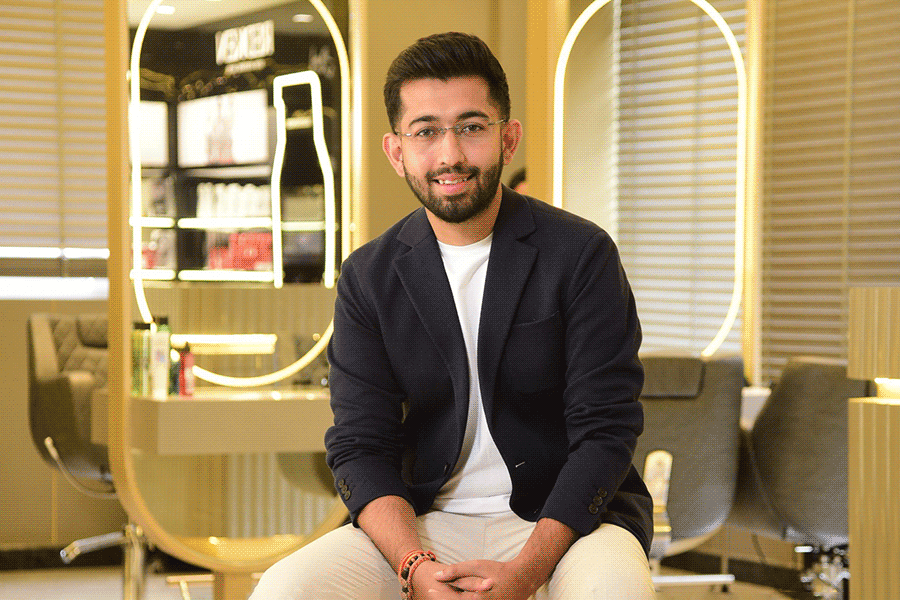

Like all businesses, the salon business also faces risks of fire, theft, arson, equipment damage and other calamities beyond its control. Instead of waiting for things to go wrong, it is always good to be prepared and this is where having an insurance is important. Emphasizing on the need for salon insurance, Pankaj Killa, Founder Head Turners Salon & Academy said, “A Salon owner should insure their salon for future uncertainties.The potent risks have to be dealt with beforehand, and not just at the time of occurrence.”

Salon incidents and impact

Running a salon has its own rewards and risks. Salons have witnessed risks of accidents during profession services. One such incident is the fire haircut mishap that took place in Vapi, Gujarat, where the client ended up getting severe burns on the neck and chest. Another incident took place in Coimbatore where a 17- year old boy suffered burns to his face during a steaming and bleaching procedure. However, in a recent eye opening incident in a % star hotel salon in Delhi, the client was awarded a 2 crore compensation for a wrong haircut.

Instances like these make salon owners sit back, take notice and introspect on the need for salon insurance which covers such mishaps. Speaking about the need for insurance, Samir Srivastava, CEO JCB Salon & Spa says “Clients come to Salons to ask for expert advice on all things beauty. They might ask you for the best brow shape for their face or the best facials for their skin or a hair color ….But as is the case for every business, we might encounter clients that aren’t satisfied with your services….very rarely, inspite of all investments in top quality product usage , extremely well trained staff there could be a rare accident.

I am for Professional indemnity insurance as it will cover the expensive costs of legal action if an accident should happen. “

According to Pankaj, branded salon chains should have insurance for their team members

as well as for their salon. However insurance for their salon itself is scarce as it is overlooked by salon owners stating it a capital expense. But the benefits outweigh the risks.

Pankaj recommends opting for Business Insurance, Product Insurance and Natural Calamities Insurance. Insuring the team members is an added bonus for the brand.

“Our salon is insured for financial uncertainties. We insist that our team members to allot a minimum amount from their salary for insurance and provident fund” says Pankaj Killa. In order to prevent accidents from taking place in a salon, he feels that a healthy and safe workplace is a basic ethic for any commercial space. “Not only have we instructed our team members to safely use their electronic tools, but we have also told them what to do in case of an electric emergency.” Apart from this, the team members are advised to also work peacefully with each other.

“Salon insurance is a life saver. Especially for financial uncertainties. After Covid19, many small to medium salon owners had to cut expenses, or shut down because of bankruptcy. Protect yourself from this man-made calamity, and insure your salon right away,” concludes Pankaj.

Insure to save yourself from Consumer Grievances

Globally salons are almost always insured, but most Indian salons need to take this step to protect their salon from debt. In countries like UK, Canada, etc, there are special insurances for the Beauty Salons, e.g. General Liability Insurance, Commercial Insurance, Professional Liability Insurance and Workers Compensation Insurance but such specific insurances are not yet available in India.

Nevertheless, here are some insurances in India that can protect you:

- Professional indemnity insurance – protects businesses and individuals who provide consultation and services that when done wrong call for a huge amount of compensation

- Professional Liability insurance that also protects accountants, lawyers, and physicians from the loss, negligence caused by them while offering the service.

These insurances will save you from panic and monetary loss in event of a customer grievance, as they are a life saver!

Get your salon insured today and offer your best services to your clients worry-free!